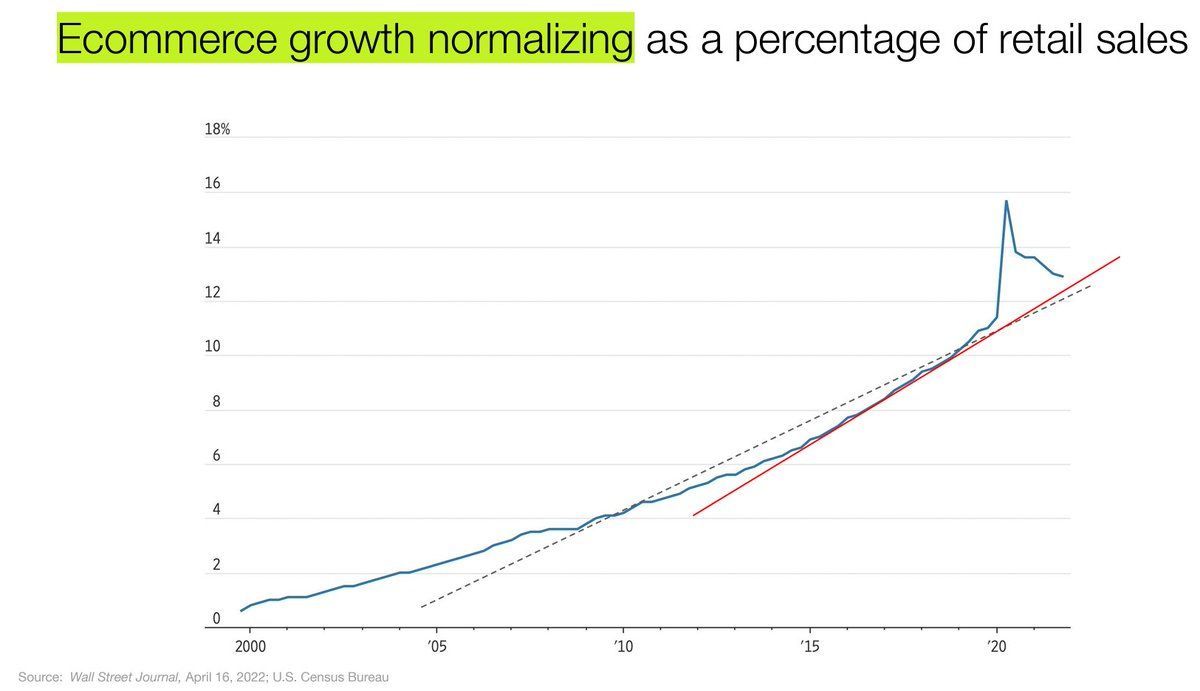

E-commerce growth normalizes as a percentage of retail sales — but why

According to trend research from the US Census Bureau, e-commerce sales as a percentage of total retail volume, has slowed down considerably. Why this is a good thing? Enjoy the read.

I have been working in e-commerce since the mid-2000s—back when online sales were a mere 2–3% of total retail volume. As I recall, there was a general consensus that online sales would continue to grow to at least 20–25% of total retail sales volume, at the time.

It is the year 2022 and we have just come out of one of the longest pandemics we have seen in decades. The covid-19 virus accelerated online sales significantly, with traditional retailers flocking towards their webshops to keep the sales momentum alive.

As the pandemic is starting to come to an end—fingers crossed—sales from online retail have started to go down.

Interestingly enough, the US Census Bureau estimates the total retail sales volume of online to be no more than 13–14% in 2021/22.

Has online growth come to a hault

From this data it appears as though online sales have come to a hault, or at least reached a plateau. The 2019/2020 peak in sales volume did not make it past the 20% mark, though.

Will revenue from online channels ever make it past the 20% of retail volume-line?

The general trend towards online retail still exists. Growth has slowed down, but it seems as though it has normalized more than ceased. Online retail is still on track to pass the 20–25% of retail volume line, in the upcoming few years, albeit slower than anticipated.

Reasons for a decline in growth

Stores have started to open back up again. Whereas tourism is not back at the level it used to be, domestic purchases have picked up considerably in most markets.

Customers want to go out and shop again. Leave their houses to gain new experiences and enjoy the world outside their homes. No wonder brick and mortar retail has bounced back quickly in the last few quarters.

However, there might be other reasons why online sales have started to slump.

- Logistical infrastructure still needs to improve, significantly

- Many traditional retailers do not know how online sales will be a part of their (omni-channel) long-term strategy; what the role of brick and mortar stores will be

- Supply is not where it could be and most retailer and brands stock their stores first, before serving their online store's needs

- Online marketing has become increasingly competitive and expensive; brands—and retailer—do not have the organizational setup and partner network to address their technical and online marketing needs, efficiently

Trend

The trend towards online retail continues, even if its growth has slowed down. I believe the mid-term trend will be a more cohesive mix between online and offline sales.

As an online marketer, I am actually glad that digital sales growth has slowed down — infrastructure continues to be an issue and traditional retailer need time to determine how online is a part of their long-term strategy

With exponential growth come exponential challenges. It is okay to take a step back and evaluate how digital can and should be a part of the long-term vision for retailer and brands alike.

As infrastructure and organizational setups improve, so will the willingness of customers to purchase online. It is a matter of time until digital sales surpass the 20%–line and I personally think that will be less than 50% of what we could expect to see in the upcoming 10–15 years.

— Remco

Other sources and online discussions

Still think "COVID has pulled 5-10 years of #eCommerce growth forward"? It very much looks more like a bump right now... pic.twitter.com/ATMn8d99hr

— Philipp Kloeckner (@pip_net) May 9, 2022